Take these 5 steps if you are a cybercrime victim.

Personal cyber insurance coverage can protect you from online extortion scams, cyber attacks, and online fraud.

What steps should I take if I have a victim of a cybercrime?

- Change your passwords and set up multi-factor authentication wherever available.

- File a report with the Internet Crime Complaint Center (IC3) or local police department.

- Inform your credit card companies, banks, and credit bureaus of the breach.

- Set up Google Alerts for your username, business name and legal and name.

- Check with your trusted insurance advisor to see if Personal Cyber Insurance is available as an add-on to your home insurance policy.

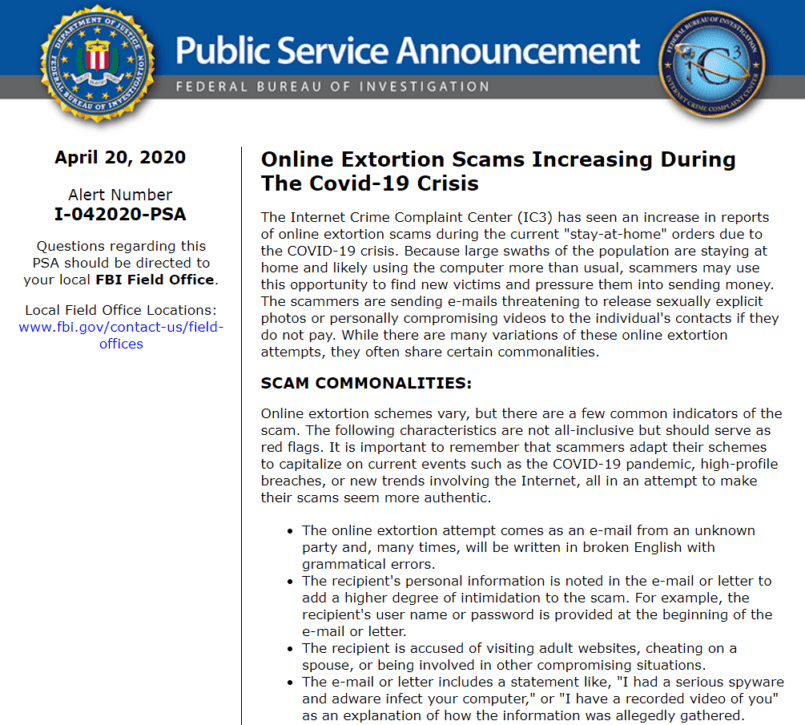

Since the onset of the COVID-19 pandemic, cybercrimes have rapidly increased and impacted families and individuals, small businesses, and large corporations.

What are some common examples of cybercrime?

Online Extortion: You log into to your computer to find that your files are locked and you cannot access your documents. A ransom email is received requesting $2,500 for the decryption key. Total Loss: $2,500

Cyber Attack: You open up a file attachment on an email that appeared to come from a friend. The attachment contained a virus and infect your computer. Total Loss: $1,000

Online Fraud: Someone fraudulently accesses your email account to acquire personal banking information and wires money to several bank accounts. Total Loss: $37,000

Online Fraud – Rental Scams: You book a vacation for you and your family and pay the $1,000 deposit to secure the rental. After a week with no confirmation or communication from the rental agency, you discover that the vacation home does not exist and your deposit is gone. Total Loss: $1,000

What does cyber insurance coverage and what steps should I take if I was a victim of a cyber crime?

- Change your passwords and set up multi-factor authentication wherever available.

- File a report with the Internet Crime Complaint Center (IC3).

- Inform your credit card companies, banks, and credit bureaus of the breach.

- Set up Google Alerts for your username, business name and legal and name.

- Check with your trusted insurance advisor to see if Cyber Insurance coverage is available as an add-on to your home insurance policy.

1. Change your passwords and set up multi-factor authentication wherever available.

It is important to change your passwords and use a variation of numbers, letters, and special characters. Set up multi-factor authentication where available and protect your smart-home devices with password-protected WiFi and recent security updates.

2. File a report with the Internet Crime Complaint Center (IC3).

The Internet Crime Complaint Center (IC3) provides an online portal to report Internet-related criminal activity to the FBI. If you are a victim of a cybercrime or want to file on behalf of another party, you can file a complaint with the IC3. The FBI regularly releases announcements updates on common scams.

Depending on the extent of the fraud and damages, you can also contact your local law enforcement office or FBI Office.

2. Inform your credit card companies, banks, and credit bureaus of the breach.

Call your credit card companies and banks immediately to inform them that your information may be compromised and someone may be using your identity. Follow the steps provided by fraud specialists and close accounts or cards that may have been compromised If stolen funds or personally identifiable information is involved, contact one of the three credit bureaus to report your crime. You can also choose to lock your credit accounts and have a fraud alert be placed on your credit report. It is never too late to implement best practices to prevent future wire transfer fraud, too.

3. Set up Google Alerts for your username and name.

A Google Alert detects content online and sends an email notification when it finds new results. You can set up a Google Alert for your username and name to see if additional information is being posted on your behalf or about you online. Learn how to create a Google Alert. You do not need to be a victim of fraud to set it up – the alerts are free and can be created at any time.

4. Check with your trusted insurance advisor to see if Personal Cyber Insurance is available as an add-on to your home insurance policy.

Personal cyber coverage is a fairly new coverage option that many carriers offer to protect you and your family from online fraud and cyber-attacks. Personal cyber coverage typically ranges from $150-$500 annually as an add-on to your homeowner’s insurance, depending on the coverage limit and availability. Cyber insurance coverage has the following benefits:

- Cyber-attack coverage pays to restore data, recover information, and restore systems that may have been lost or damaged following a malware attack or unauthorized use of your devices.

- Cyber extortion coverage provides professional assistance when responding to demands made by cyber criminals to damage, distribute, deny access, or disable content from your systems or devices.

- Online fraud coverage pays for damages that result in a direct financial loss due to forgery, counterfeit currency, illegal bank transfers, and other phishing schemes.

Whether you are a victim of cybercrime or trying to take steps to prevent cyber-attacks, Evarts Tremaine can help. Contact an insurance advisor at Evarts Tremaine to make sure that Personal Cyber coverage is included on your policy today.