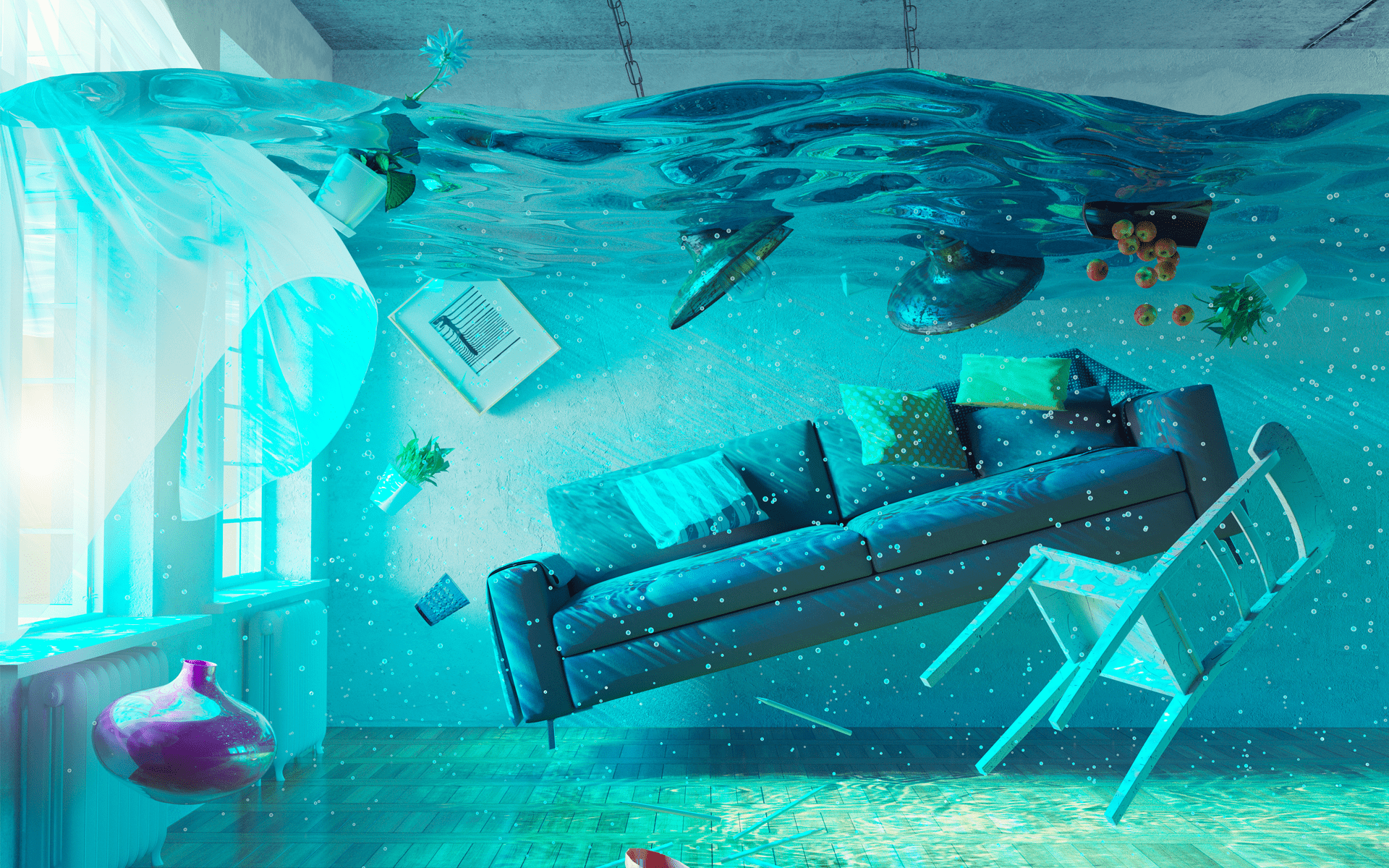

Water damage to your home is one of the most common causes of a homeowner’s insurance claim. Understanding the coverages on your homeowner’s policy can help you determine what options are available to you.

Homeowner’s insurance typically covers damage from water when it is weather-related or sudden and accidental. Homeowner’s insurance does not cover floods. Generally, you will find coverage on your homeowner’s policy for the following types of water damage:

- Roof leaks from wind or hail damage

- Burst, frozen, or ruptured pipes, if sudden and accidental

- Dishwasher hose and other appliance related water damage, if sudden and accidental

While this list is not inclusive and it is important to consult with your insurance advisor for details, you will generally not find coverage for the following types of damage, or need a special add-on for coverage:

- Gradual water damage due to maintenance issues or wear & tear over time

- Ground seepage through the basement is generally not covered.

- The source of the water damage may not be covered. This means that while the resulting water damage of a broken washing machine may be covered, depending on the circumstances, the policy will not likely replace the washing machine itself

- Water back-up – An add-on coverage is available for your home to provide coverage for water that backs up through sewers or drains.

- Flood damage is never covered on a standard homeowner’s policy, but is available through the National Flood Insurance Program. This means that floods such as rising waters or overflow of bodies of waters are never provided coverage on a home policy.

Do you have questions or want to review the water damage covered on your policy? Contact an account manager at Evarts Tremaine today.